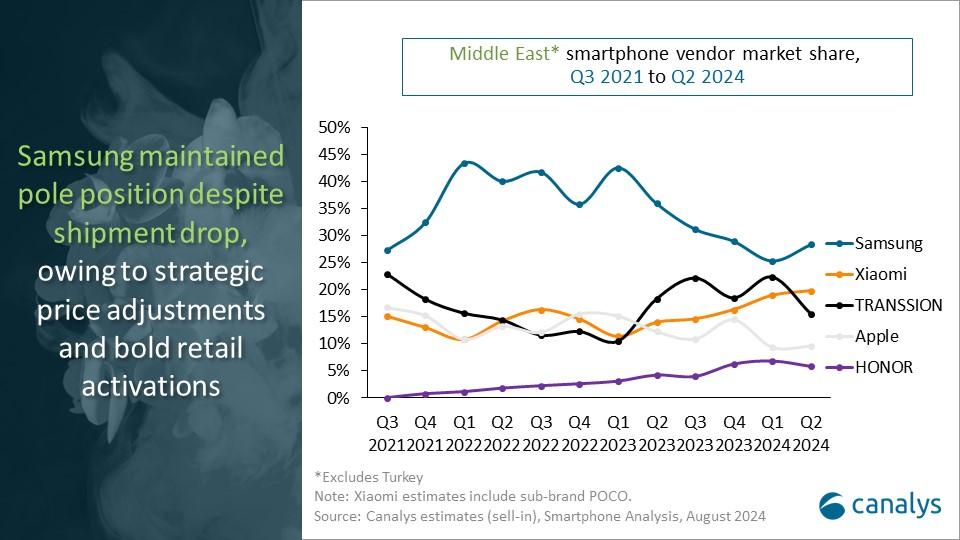

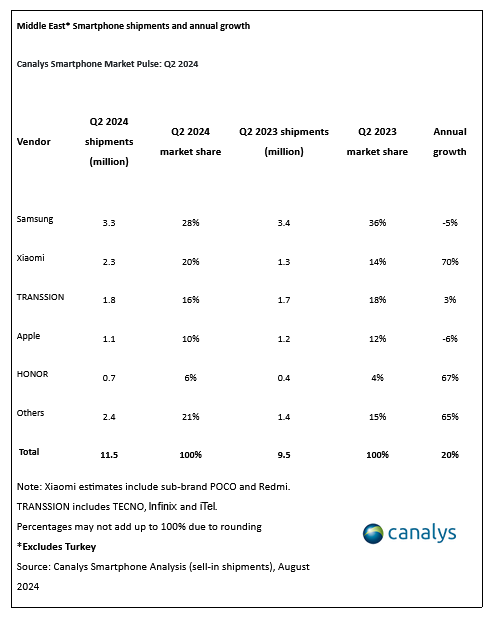

Smartphone shipments in the Middle East market (excluding Turkey) in Q2 2024 saw a remarkable 20% year-on-year increase, reaching 11.5 million units.

According to the Canalys report, this growth was driven mainly by strong economic stability, government policies favouring consumer demand, and strategic technological investments. Notably, smartphone makers among the top 5 brands in the Middle East lowered their average selling price (ASP).

Samsung maintained its position as the market leader in the Middle East in Q2 2024, with a 28% share, though shipments fell 5%. Xiaomi hijacked the number two position from Transsion with a 20% market share.

By lowering its average selling price (ASP) of smartphones in the sub-US$200 segment by 14%, Xiaomi was able to beat Transsion at its games. The smartphone maker saw a 70% growth from competitively priced models such as Redmi A3, 13C, and 13 4G.

Transsion sits number three with a 16% market share, a decline from its former number two position. Apple comes fourth with a 10% share, while HONOR wraps the number five position with a 6% share.

Transsion Q2 2024 Market Performance in the Middle East:

Infinix and TECNO showed significant resilience and growth in the Middle Eastern market in Q2 2024. Together, these brands captured 3% of the total market share, thanks to their competitive pricing strategy and strong appeal in the mass-market segment, where affordability and value for money are crucial.

Transsion faced heavy competition from Samsung and Xiaomi, with the latter offering competitively priced smartphones. However, Infinix and TECNO maintained their growth by focusing on sub-$200 smartphones, which are highly sought after in the region.

On the other hand, the average selling price (ASP) for the Transsion brands decreased, reflecting their focus on affordability.

Infinix contributed to almost 49% of Transsion’s total volume in the region, showcasing its strong position as a leading brand within Transsion’s portfolio.

Meanwhile, TECNO, which is still expanding its presence in the region, has entered into a strategic partnership with Lulu Hypermarkets in Saudi Arabia. This partnership is expected to drive future growth, particularly in areas with a larger expatriate population.

Country-Specific Insights:

- Saudi Arabia: The smartphone market grew by 13%, bolstered by strong retail and F&B sectors and increased consumer activity during the Hajj season. TECNO’s partnership with Lulu Hypermarkets is expected to tap into this growth, especially within the expatriate community.

- United Arab Emirates: TECNO and Infinix are set to benefit from the 19% market growth, driven by international visitors and significant investments in tourism infrastructure.

- Iraq: The market saw a 22% growth, though future operations may face challenges due to economic issues and Central Bank restrictions on the US Dollar. Sitting among Iraq’s top 5 smartphone vendors, Transsion isn’t new to these challenges.

- Qatar and Kuwait gained 14% and 17%, respectively, fueled by festive spending and easing inflation.

Canalys analyst Pravinkumar advises brands to innovate with technologies such as GenAI and enhance their ecosystem offerings to stay competitive in the long term. Embedding sustainability practices will also be key to maintaining consumer loyalty in an increasingly competitive market.

Related:

- Infinix Sales Skyrocket by 100% in Russia: Q2 2024 Avito Report

- TECNO and Infinix Achieve 52% Yearly Growth in Latin America – Q2 2024 Report

- Samsung Hijacks Top Spot from Transsion And Apple: Q1 2024 Smartphone Report

Certified tech nerd 🤓 always digging into gadgets to see what makes them tick.

When I’m not geeking out, I’m either exploring the legal landscape, lifting weights 🏋🏾♂️, gaming 🎮, reading 📚, or vibing with the crew 😂.

infinix zero 5g 2023 turbo

Model x6815C

Serial number 094243131H011279

Android version 14 update

how much time is coming and charging fast charging problem

My phone